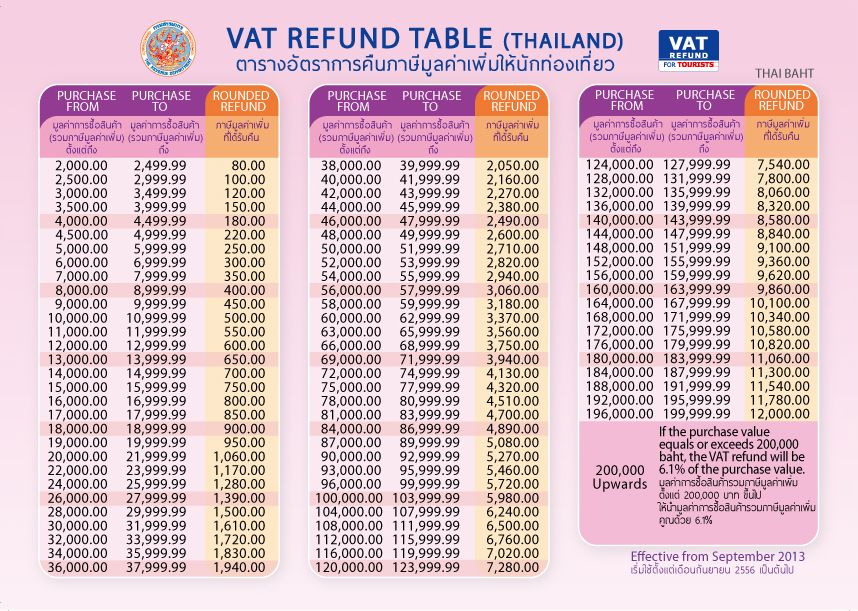

Vat refund calculator

Enter the net sales price of the goods or service. UKs refund rate ranges from 43 to 167 of purchase amount with a minimum purchase amount of 30 GBP 33 EUR per receipt 25 GBP for Premier Tax Free locations.

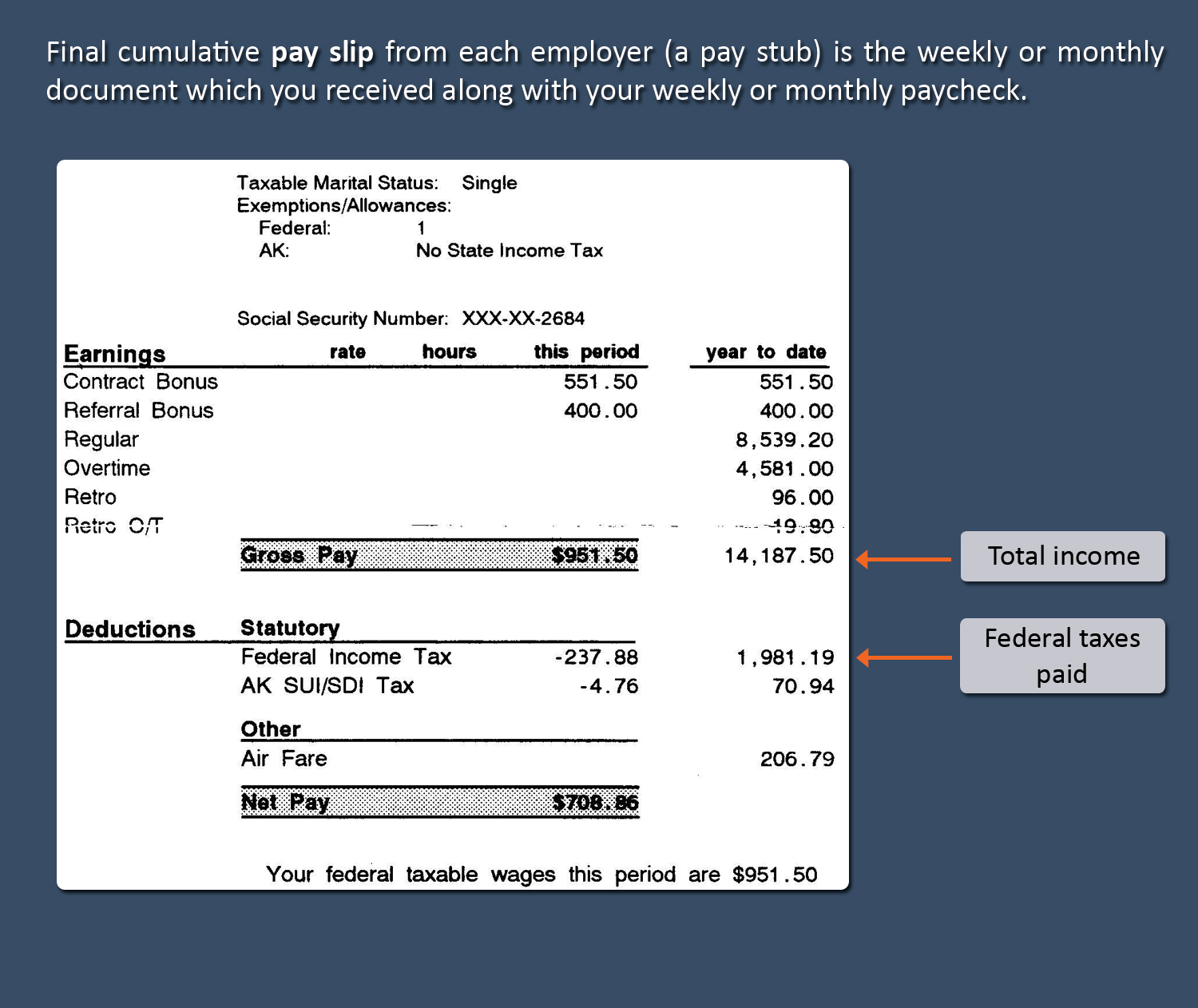

Ambertax Usa Tax Refund For J 1 H 2b And Other Temporary Visitors

This cookie is set by GDPR Cookie Consent plugin.

. SHOP TAX FREE Card. Our handy online calculator lets you calculate how much VAT you can reclaim in up to 30 countries. Save up to 21 in Spain.

SAVE UP TO 19 WHEN YOU SHOP IN EUROPE AND CLAIM YOUR VAT REFUND HOW TO RECIEVE THE VAT REFUND for non-EU resident 1 Purchase Make purchases in any store which. Select the VAT percentage rate to. Tax-free shopping is a breeze with Refundit App on your phone.

Please note that the calculator reflects only the. VAT-registered businesses can reclaim VAT theyve paid to other businesses this claim is made. A tax refund calculator will help you to estimate your earnings tax liability and avoid any mistakes and discrepancies in your tax return in the UAE.

How to Shop Tax Free Shop Tax Free and save up to 19 Read more Scroll to Bottom. The VAT reclaim process has never been quicker or. Shop the world while we.

This cookie is set by GDPR Cookie Consent plugin. In case you have ever experienced any. Simply enter the gross sum choose vat calculation operation include or exclude tax percentage and press Calculate or enter button to calculate VAT amount.

Enter amount CALCULATE YOUR REFUND. A business becomes VAT-registered when it registers with the tax authority for VAT. Enter the description of the goods or service provided.

Book your business trips with TravelPerk to make it easy to get up to 21 of your spend back. Reclaim your VAT on your business travel and save up to 25. The cookies is used to store the user consent for the cookies in the category Necessary.

Tax-free shoppers can quickly calculate their VAT refund amount with the Refundit calculator. CALCULATOR OF THE VAT REFUND. You need to have permanent.

Denmarks refund rate ranges from 118 to 175 of purchase amount with a minimum purchase amount of 300 DKK 40 EUR per receipt. Refunds are calculated based on each countrys VAT rate minus a 9 fee other refund operators might charge you up to 60 of the refund.

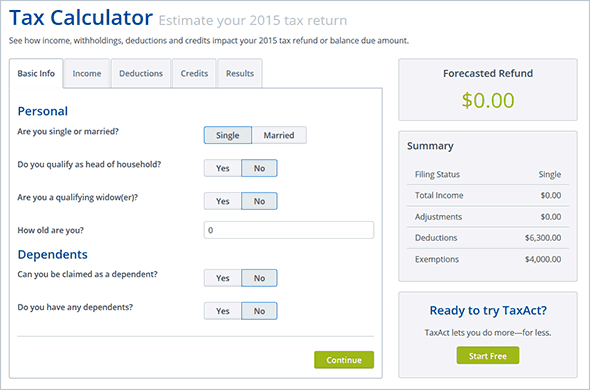

See Your Refund Before Filing With A Tax Refund Estimator

How To Estimate Your Tax Refund Or Balance Due Taxact Blog

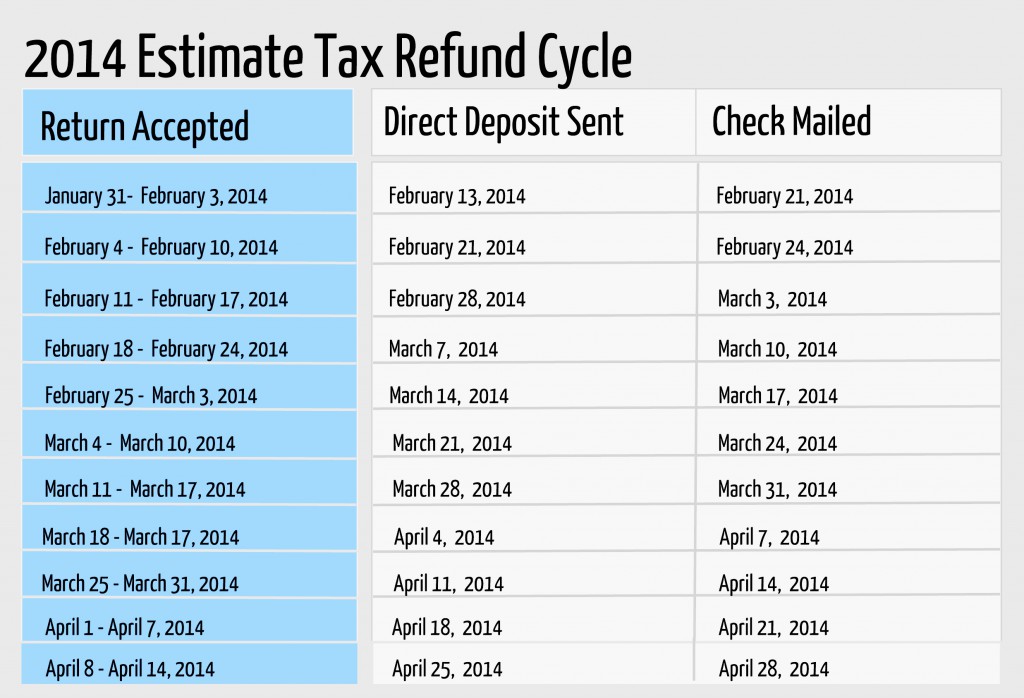

2014 Estimate Refund Cycle Chart Rapidtax Blog

Vat Refund Calculator For Business Travel Travelperk

Vat Refund Table Thailand The Revenue Department English Site

How To Calculate Your Federal Income Tax Refund Tax Rates Org

New Tax Calculator Shows Taxpayers Their Tax Bill Under Many Scenarios Tax Foundation

See Your Refund Before Filing With A Tax Refund Estimator

Ambertax Usa Tax Refund For J 1 H 2b And Other Temporary Visitors

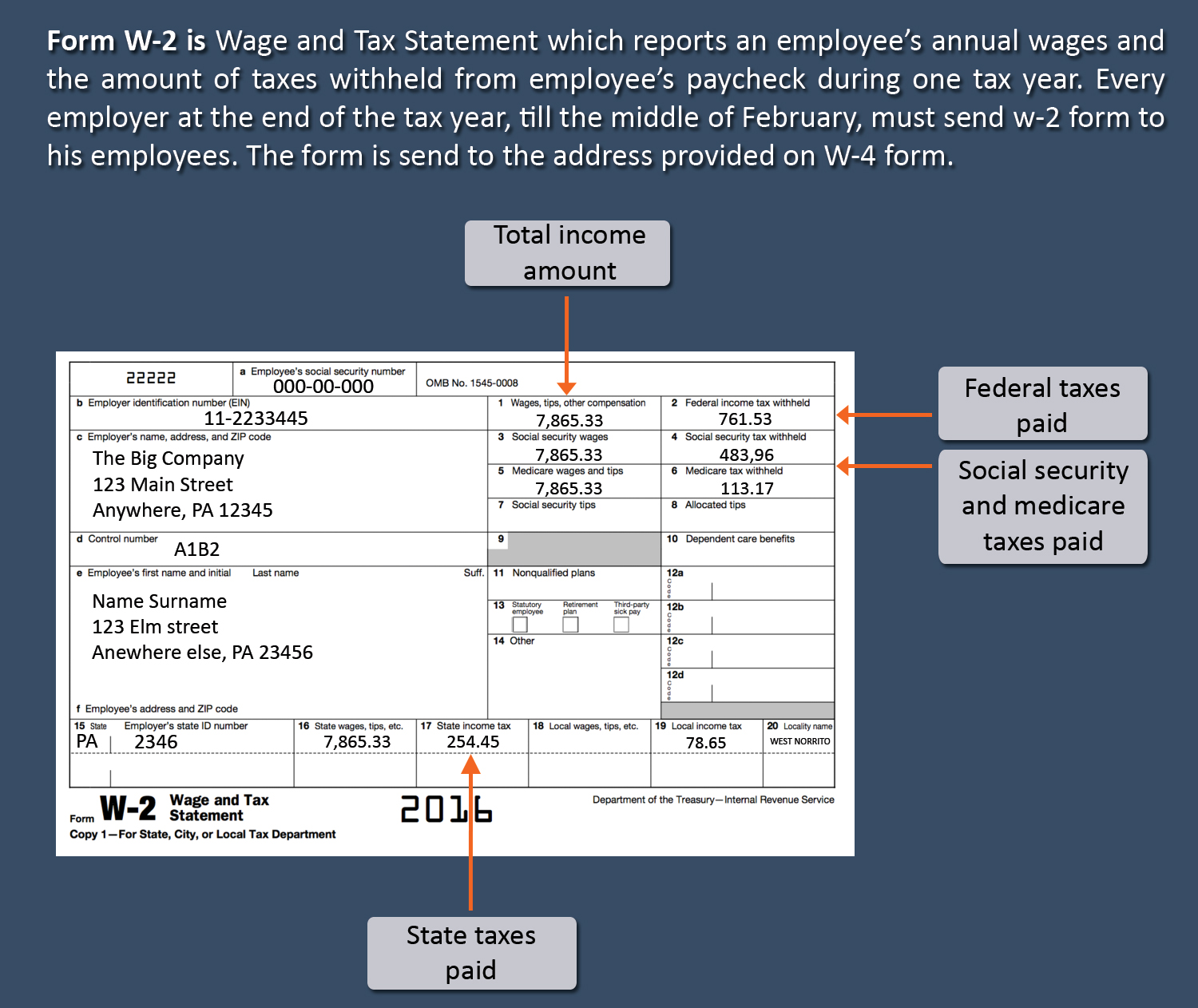

Tax Return Calculator How Much Will You Get Back In Taxes Tips

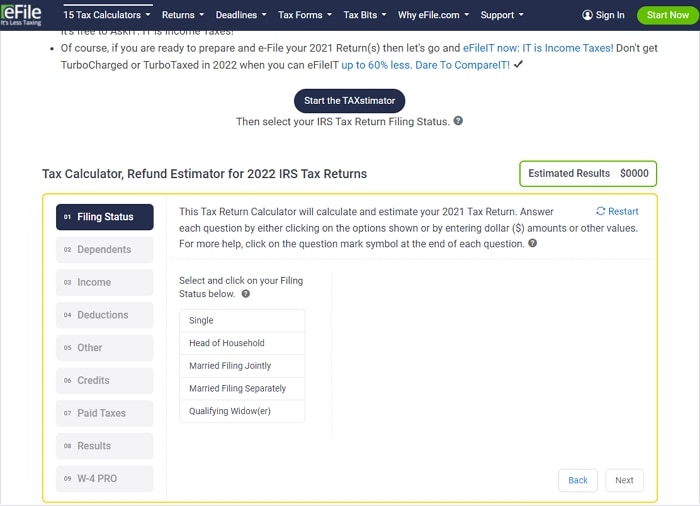

Top 5 Tax Return Estimators 100 Free

Vat Refund Calculator For Business Travel Travelperk

Top 5 Tax Refund Calculators To Ease Tax Refund Estimate Process

Tax Return Calculator How Much Will You Get Back In Taxes Tips

.jpg)

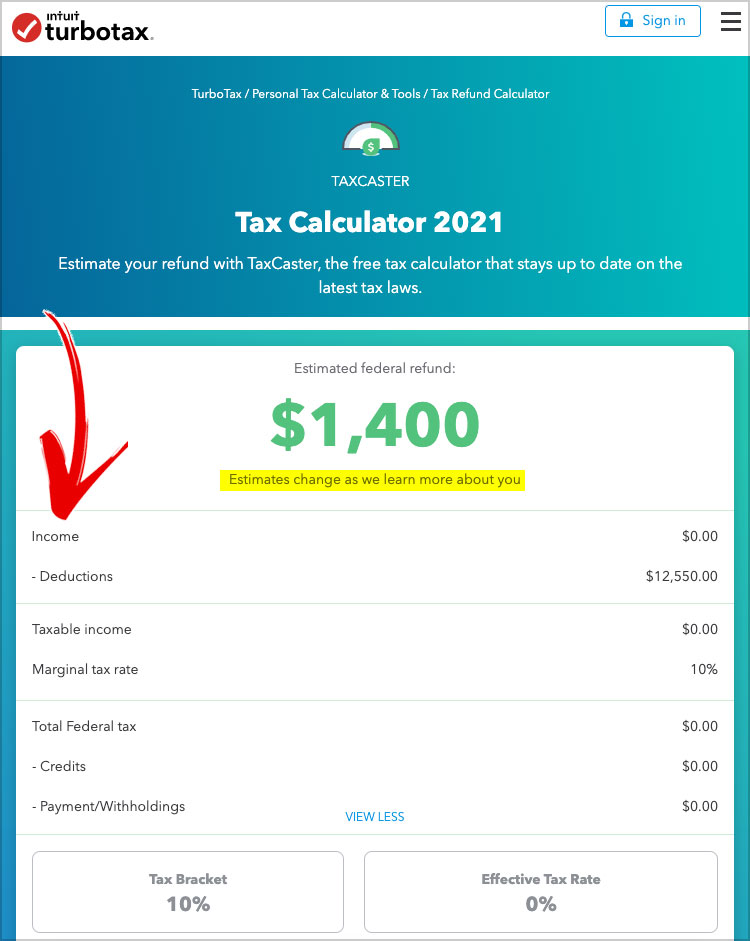

Income Tax Calculator Estimate Your Refund In Seconds For Free

1 Free Tax Refund Estimator In 2022 Turbotax Taxcaster

Vat Calculator